Is it gonna be a tough year or a rough year?

Thoughts on 2023; takeaways from recent industry exec conversations

“If you’re going through hell, keep on going.” - Rodney Atkins

“Learn to deal with the valleys. The hills will take care of themselves.” - Quincy Jones

“Nobody knows how the story ends. Live the day, do what you can.” - The Lumineers

February’s now here. Happy Valentine’s Day! And this year it’s likely carriers sending chocolates and flowers to shippers to court their freight. As we finish off “earnings season” (the period when all the public companies report their quarterly financials), we’re still processing all the various 2023 outlook commentary and forecasts. Having an opinion and crafting a most-likely future was my job for over 20 years on Wall Street, because investors want to constantly compare their views to the expectations of others, in search of mispricings and investment opportunities. If an analyst can provide a compelling story of the future that is different than what most are saying, and the buy-side client believes it to be more accurate (and both are directionally correct), money can be made.

But those running the various businesses (e.g., truckload carriers, logistics companies, railroads, airlines, shippers, etc.) should not be as concerned about the 12-month outlook for the macro or externals. For example, yes - you probably want to know if it’s likely to rain today. And, if so, you can bring an umbrella with you. But it shouldn’t fundamentally alter what you have to do.

Where are we?

It’s conference season, and I’ve had the pleasure to attend two conferences recently - the BGSA Supply Chain Conference and the Stifel Transportation & Logistics Conference, spending time with many top execs across the logistics industry. From the panels to the hallway discussions to the coffees to the dinners, there was a lot of opining on the future and general agreement that today is tougher for carriers than last year. But not a clear consensus as to how 2023 should unfold.

According to Yellow CEO Darren Hawkins, even though the tables have turned a bit in shipper negotiations recently, we’re not in hell (at least not the economy and not the freight markets). And he’s seen it. Maybe soon. Maybe not.

Then there’s XPO/RXO/GXO Chairman, Brad Jacobs, who sees us on the front end of a potential five-year-long stagflation environment ahead with massive AI disruption. And he’s been intensely researching future trends, looking for his next big industry roll-up opportunity.

But back to the first quote at the opening of this piece, the point is that it’s less important where you think we are than to keep on moving through. The point of the second is to expect ups and downs through time and to have a plan for the tough times, as it’s harder to make it through those than through the good times. And the third and final quote at the top is a reminder that worry (about things outside your control and about events that most likely will not happen) is toxic and to just focus on the day. So, where are we? We’re here today. There’s ample capacity to move the freight that needs to be moved.

Where are we going?

First, setting the frame. 2021 was an incredible boom year for the transportation/logistics/supply chain industry. Beyond a normal bull market period due to massive government stimulus and a shift to goods spending over services spending, the strong demand was coupled with supply constraints - China lockdowns/plant shutdowns, labor shortages, parts shortages, chassis shortages, etc. - which dropped inventories to record lows and shot transport prices to record highs.

2022 was still very good, but signs of cooling off from the overheated condition started early in the year. Truckload (spot) rates dropped first. Inventories began to build. By the summer, ocean rates had cooled significantly and kept falling hard through year-end back to pre-pandemic levels. Airfreight also dropped a bit with no significant 4Q22 peak season.

Now moving into 2023, demand has softened, freight rates have collapsed in some modes, and capacity is still growing. Drivers are easier to find. And shippers can stop putting out fires and take a breather. Same with carriers.

Time to get back to work in a calmer, more measured fashion. Time to make decisions with a clearer head. Are inventories now too high? Still too low? Well, that depends. In some cases, the wrong inventory has been built up, so expect some level of retail discounting this year. In other cases, like the automotive sector, there is still some room to run on the restocking. [I talked more about all this and more in a podcast interview last month with Logistics Management.]

Many carriers are expecting, predicting, or at least talking about a “back-half” recovery. Growth to begin again mid-year. Maybe. But I’ll take the “over”. Can’t tell you how many times companies have said at the start of a year that “it’s tough now, but the back half will be better.” It is more likely that we’ll see more normal seasonality in freight flows through the end of 2023. And with a startling lack of typical seasonality in 4Q22, it would create a favorable comp. But not anything to get too excited about.

This year is likely to be OK, but after such a supply chain mess of the last few years, I think it will take a bit to clean everything up. In the meantime, we’re still dealing with significant inflation and a shift to services spending - both net negative for goods movement.

Reset year.

My view is that this will be a “reset year” in the supply chain world.

Expect a flood of RFPs across all freight modes in 2023.

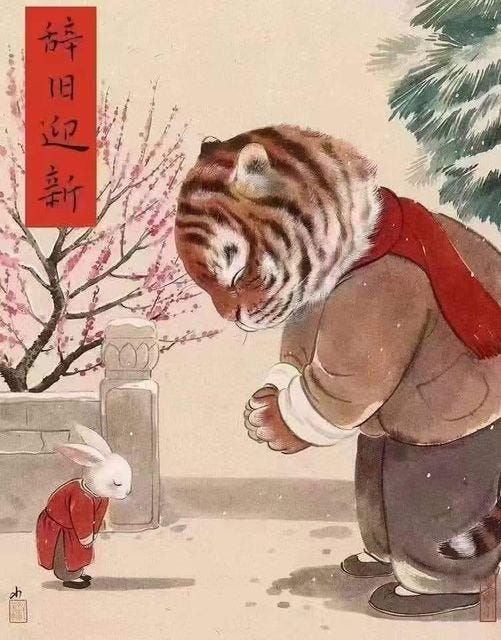

On January 22, we moved out of the Year of the Tiger and entered into the Year of the Rabbit. See below excerpt from Astrologist Suzanne White’s Substack, “Suzanne Sez”, re: The Year of the Rabbit, which talks of the need to decelerate (and reset) after a stressful period. That’s 2023.

“PROSPERITY. HARMONY. PEACE AT LAST.

In Rabbit years, life slows down. After the tumultuous and difficult Tiger year we lived through (or didn't), we all need to decelerate. Nature must have planned it. Give people a treacherous Tiger year, full of war and pestilence, struggle, strife and illness. Then give them a whole year to recover. So let's think of the Rabbit Year as a 12 month long convalescent home for us troubled soldiers and other hopeless cases.”

So, what does a reset year mean for shippers, carriers, 3PLs, and others?

It’s a time to move from defense to offense. It’s a time to think strategically vs. tactically. It’s a time to make decisions on your network, your supply chain, your inventory levels, etc. based on your organizational goals. It’s much more than just renegotiating rates. We should see improved modal selection this year (e.g., air vs ocean, LTL vs TL, TL vs Intermodal, OTR vs Dedicated). Carrier mix and broker selection will be examined. And as BlueGrace Logistics CEO Bobby Harris said, “fortune favors the better operators.” Over the last couple years, anyone could hang on and make money - you didn’t need differentiation, as long as you were at the table. Now, those 3PLs and carriers with better service should be able to grow market share, as shippers get more selective. It’s also now a chance for shippers to see who’s out there doing a good job (including who’s changed their business for the better) and invite some new providers into the mix. Speed of the overall supply chain will be looked at as well - do we need faster or slower? What’s right for our product and our customer? And nearshoring/reshoring will continue to move forward, as long-distance supply chains remain fragile, and disruption is far from over.

***

Past Posts

Beyond Logistics post #1 re: Trucking 101 —> here

Beyond Logistics post #2 re: Life —> here

Beyond Logistics post #3 re: Pricing —> here

Beyond Logistics post #4 re: Communication —> here

Beyond Logistics post #5 re: Technology —> here

Beyond Logistics post #6 re: 3PL trends —> here

Beyond Logistics post #7 re: Lessons from Comics —> here

Beyond Logistics post #8 re: Cleaning Up Inside —> here

Beyond Logistics post #9 re: All Bad Things Must End —> here

Beyond Logistics post #10 re: Better Questions —> here

***

About the author: Dave Ross currently serves as Chief Strategy Officer at Ascent and EVP at Roadrunner. Prior to his current roles, he was Managing Director and Group Head of Stifel’s Transportation & Logistics Equity Research practice, where he spent >20 years researching and writing on the freight transportation & logistics industry. Based in Miami, FL, he’s also an artist, connector, investor, dog dad, and serves on a few select non-profit boards (CTAOP, Humane Society, and Fountainhead).

** All opinions in this piece are solely those of the author and not intended to represent those of Ascent Global Logistics or Roadrunner or other affiliated entities.

Thanks for reading Beyond Logistics! Subscribe for free to receive new posts and support my work.

***